It’s time for another addition to our Eight Dates series. So far, we’ve talked about Trust & Commitment, Addressing Conflict, and Sex & Intimacy. This week, the subject is Work & Money, also known as Date #4 in Eight Dates: Essential Conversations for a Lifetime of Love by John Gottman, Julie Schwartz Gottman, Doug Abrams, and Rachel Carlton Abrams.

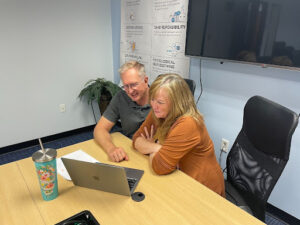

As promised, Eric and I went on another date to talk — you guessed it — money. I’ll admit, this has never been a super fun topic for us. In fact, money has always been one of our biggest areas of conflict.

But through many conflict conversations, and especially this one through this book, we have come to a NEW DISCOVERY! That is a big deal after 42 years of marriage!

The questions in this chapter — on each of our family histories — were very helpful in understanding how and why Eric and I approach money so differently. This, in itself, wasn’t a big revelation; we have known for a long time that our family histories have had a huge influence on how we see money and how it informs our spending and saving.

But what we came to realize after all this time was that our family history in combination with our Core Values has a LOT to do with our challenges in this area.

Here’s what that looks like. Eric is an Innovator. He also comes from a highly financially conservative family; his parents always paid for things as they went, even going so far as to build a vacation home in the mountains with cash. As such, Eric is hard-wired to plan ahead for all our expenditures.

I, on the other hand, am a high Merchant. Love, empathy, relationship, and vision are at the center of my soul. I was raised in a family that lived in the moment. Unlike Eric’s family, parents relied on a lot of credit to run the family restaurant business and make ends meet. As such, my ideas about saving and spending were a lot more relaxed. Compared to Eric, I grew up much less anxious about debt and having a balanced budget.

Over the course of our relationship, Eric has come to realize the importance of being in the moment and appreciating how we can be there for others, creating memories in the here and now versus always being worried about spending too much. It has shifted his understanding of why I have always put the needs and wants of others before our family budget.

However, we both know there needs to be a compromise.

And this is where the conversation from our recent date really was a gold mine for us. It may have been the first time Eric and I have ever really seen each other in a deeper light with regard to our financial life.

For Eric to feel safe and secure in our relationship, he needs to have a budget. He needs to feel confident that there’s a safety net before he can freely enjoy spending. Fortunately, Eric’s 40 years of teaching (and a great retirement plan) have set us up well. We now have money to have a little more freedom, and he feels more at ease knowing we are well set for our future.

But what Eric realized for the first time is how different we are when it comes to my need to live in the present. I need to be able to spend and to shower my family with good things. What’s more, when Eric is able to live in the moment right alongside me, I feel immensely loved.

It has been a long, hard battle of multiple conversations to get to this place of appreciating each other’s differences, but what a relief it is to be in this place!

May you have these conversations and come to a deep understanding much sooner than we have!

Join us in exploring more of the Eight Dates (we still have four more to go!) You can get the book and/or download the summary of each date here.